December 17, 2024

What the Data Says: Holiday Shopping Trends

The 2024 holiday shopping season is poised to set new records. This year, the season has extended further than ever before, with continual deals starting increasingly early. Amazon’s Turkey 5 sales period evolved into the Turkey 11 last year, and this year expanded again to Turkey 12. Similarly, Walmart introduced Black Friday deals early in November, offering three weeks of promotions. Other retailers, including Target, have Black Friday-like deals stretching across November and December.

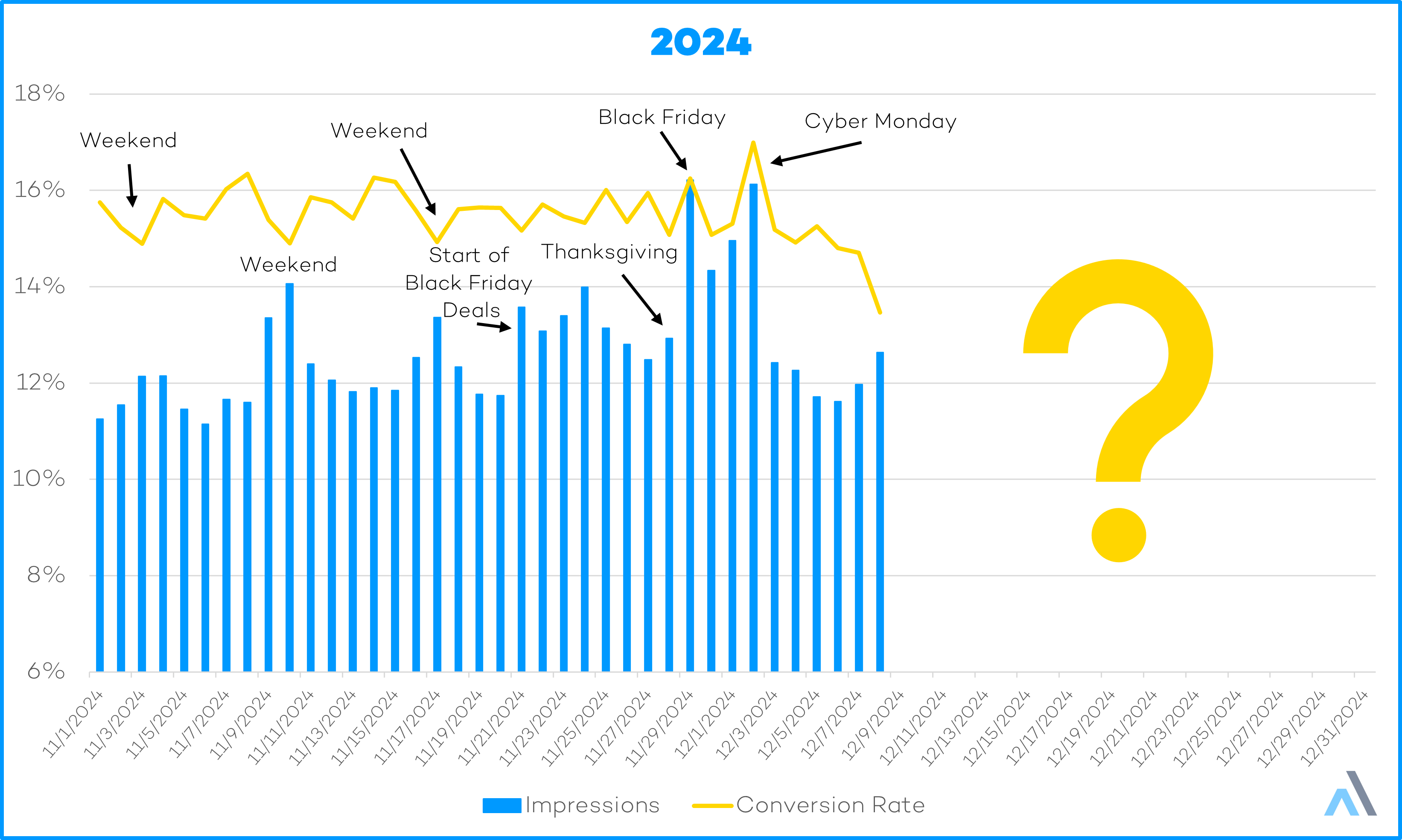

Adobe Analytics reported that online Black Friday sales reached a record $10.8 billion this year, up from $9.8 billion in 2023. Cyber Monday also achieved new heights, with online spending surging to $13.3 billion. While overall sales have increased, the impact of specific days like Black Friday has diminished due to the prevalence of continuous deals. As predicted, traffic patterns show fewer peaks and valleys, supporting the trend of more consistent shopping behavior.

2024 Amazon Sponsored Ads Analysis

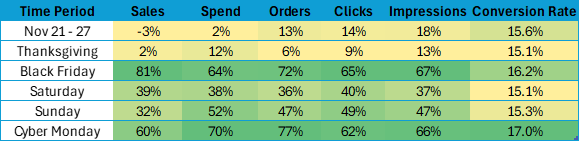

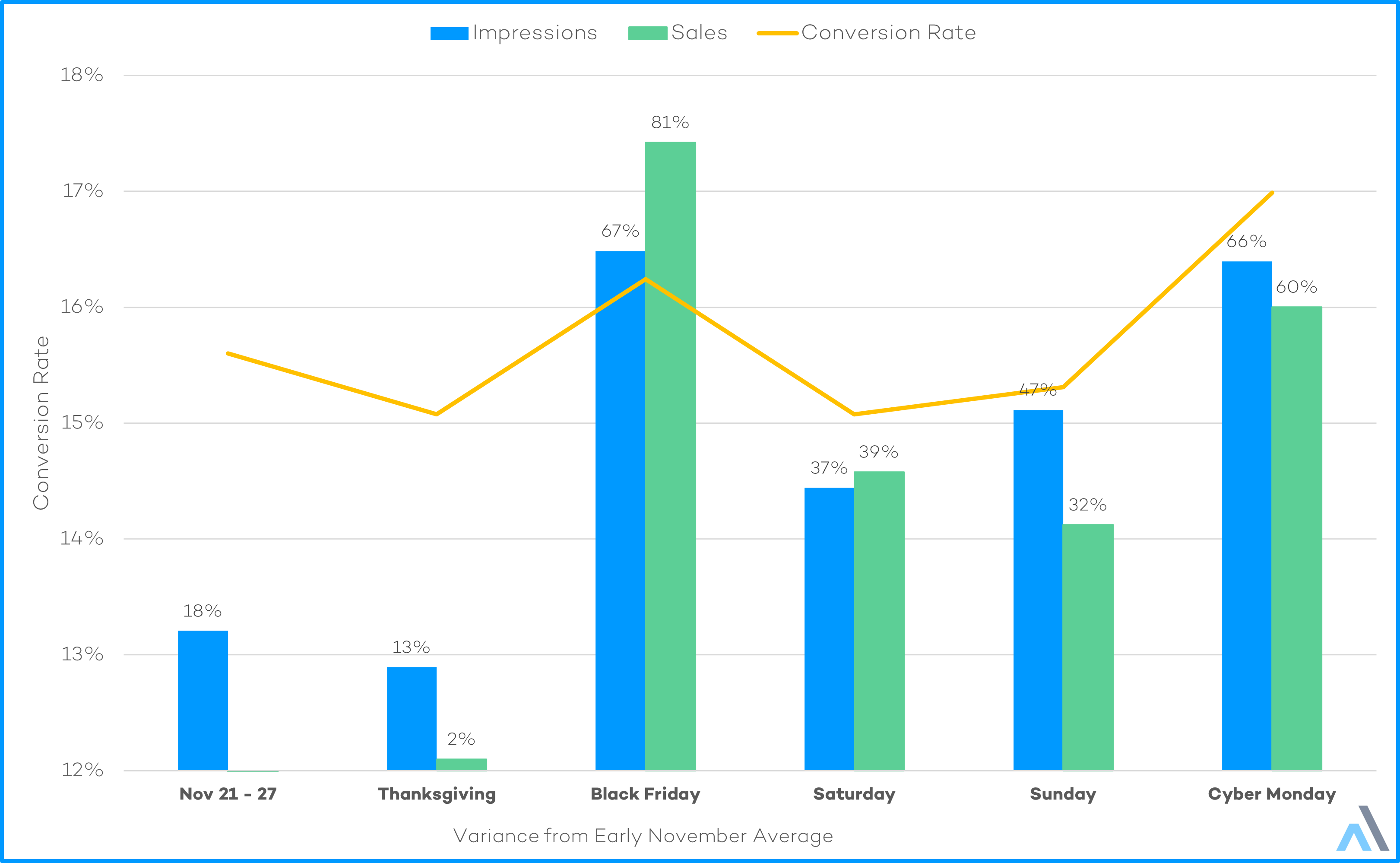

This analysis compares “deal day” data with average metrics from early November, focusing on Amazon Sponsored Ads in the U.S. market. Variances are expressed as percentages:

-

Week 1 of Deals (Nov 21–27): Impressions (traffic) rose by 18% compared to early November averages, while the Conversion Rate (Orders/Clicks) remained steady. This indicates increased browsing activity but limited readiness to purchase.

-

Thanksgiving: Traffic experienced a modest lift, but the Conversion Rate saw a slight decline, consistent with previous years’ trends.

-

Black Friday: Both traffic and sales peaked, demonstrating strong shopper engagement and purchasing activity.

-

Saturday/Sunday: The weekend between Black Friday and Cyber Monday showed the largest dip in Conversion Rate. Although traffic and sales declined from Black Friday levels, they remained above early November averages.

-

Cyber Monday: Traffic and sales rebounded significantly, with the highest Conversion Rate of the Turkey 12 period. Urgency to purchase likely drove this performance.

2019-2024 Holiday Shopping Trends

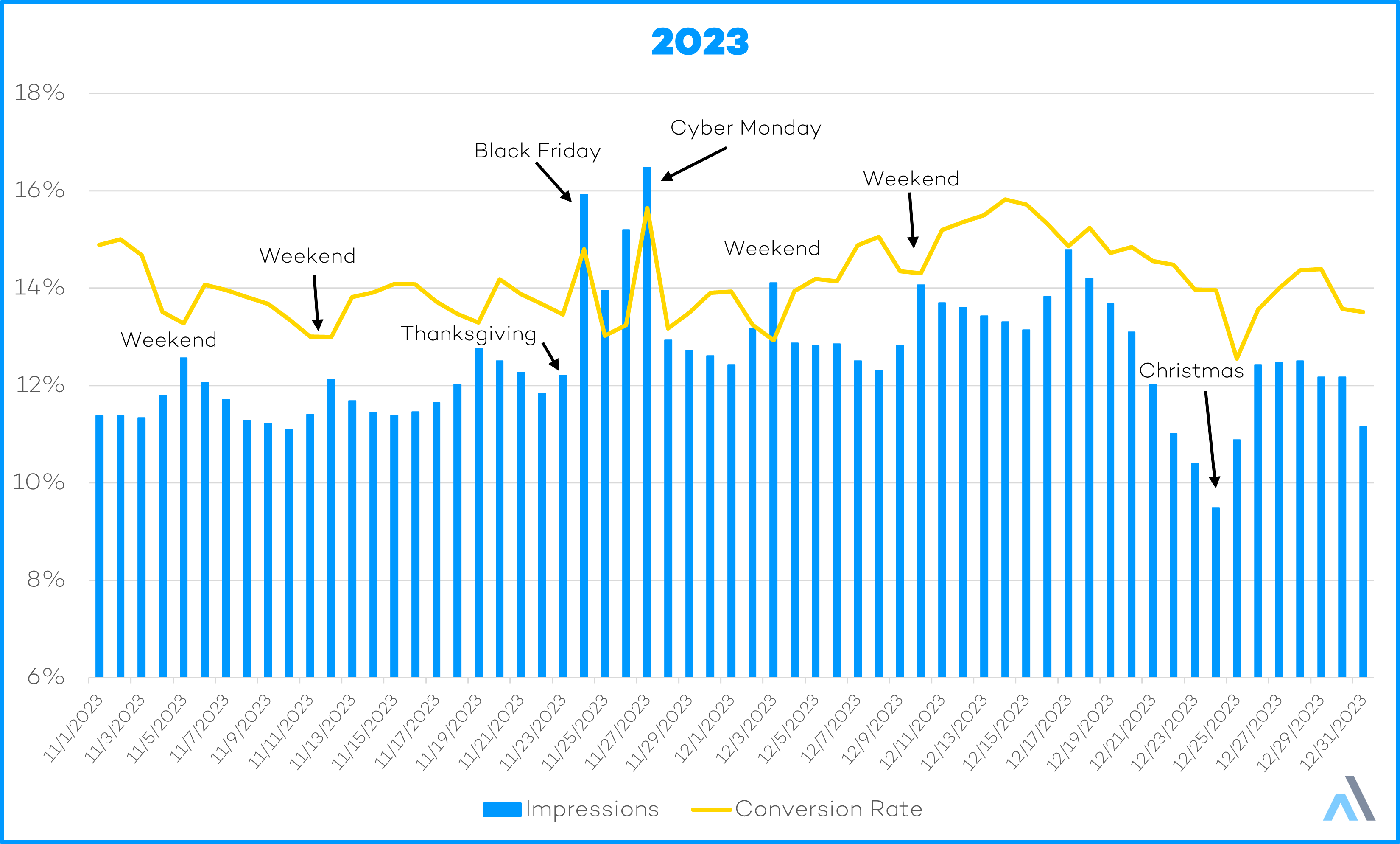

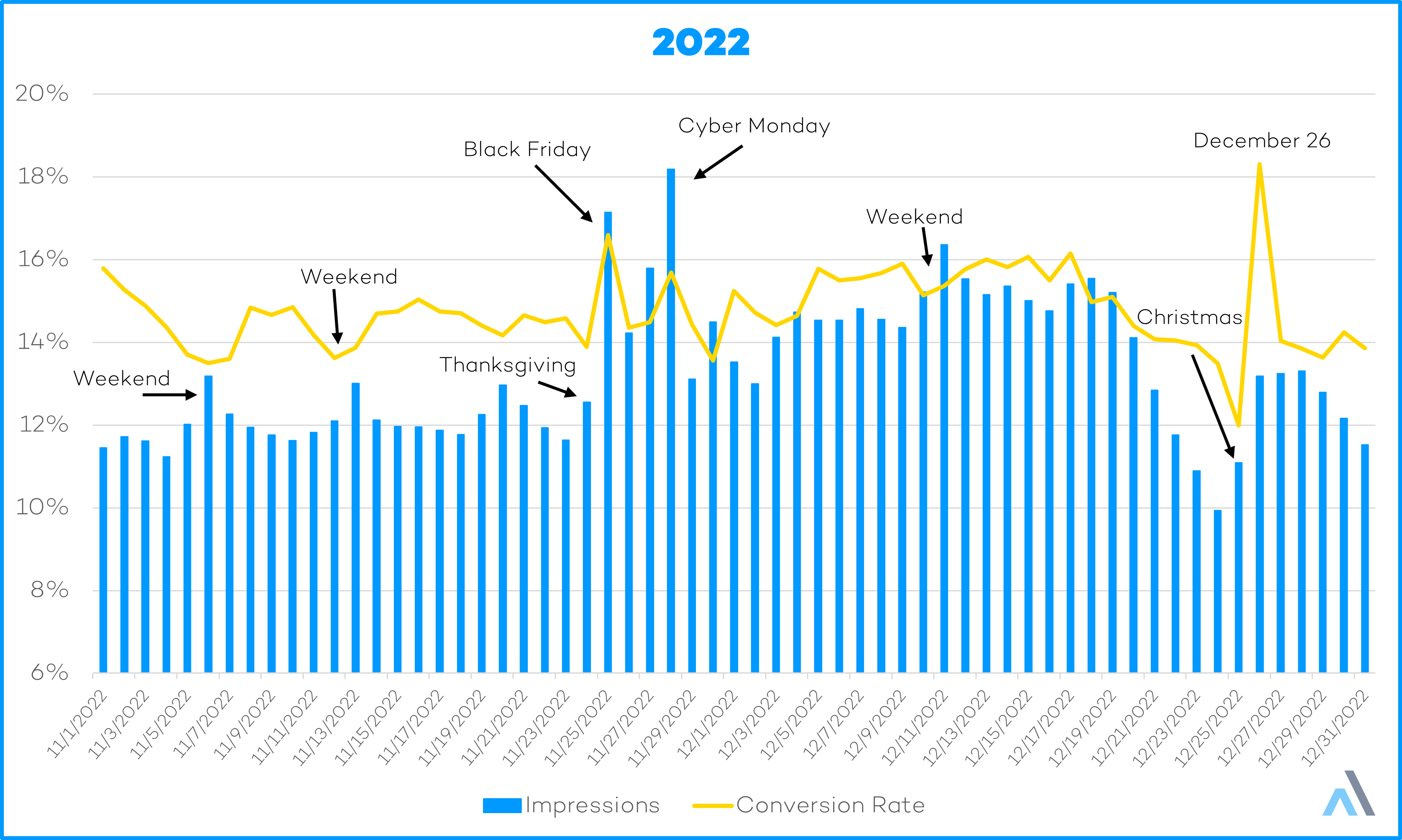

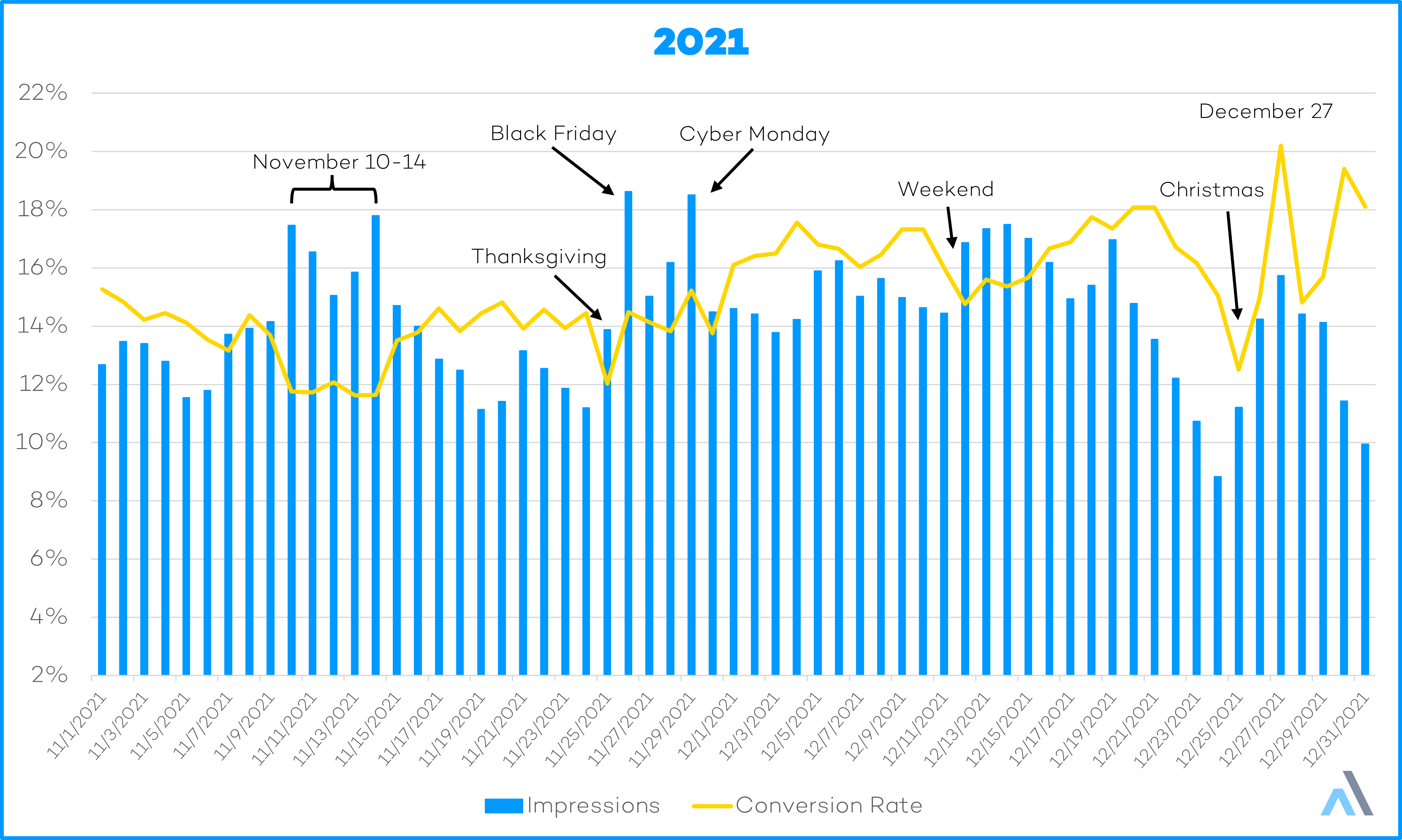

A review of five years of holiday shopping data reveals consistent patterns in shopper behavior. Key observations include:

-

Weekend Behavior: Shoppers tend to browse but not purchase as actively over weekends. This trend aligns with broader Day-of-Week analyses conducted throughout the year.

-

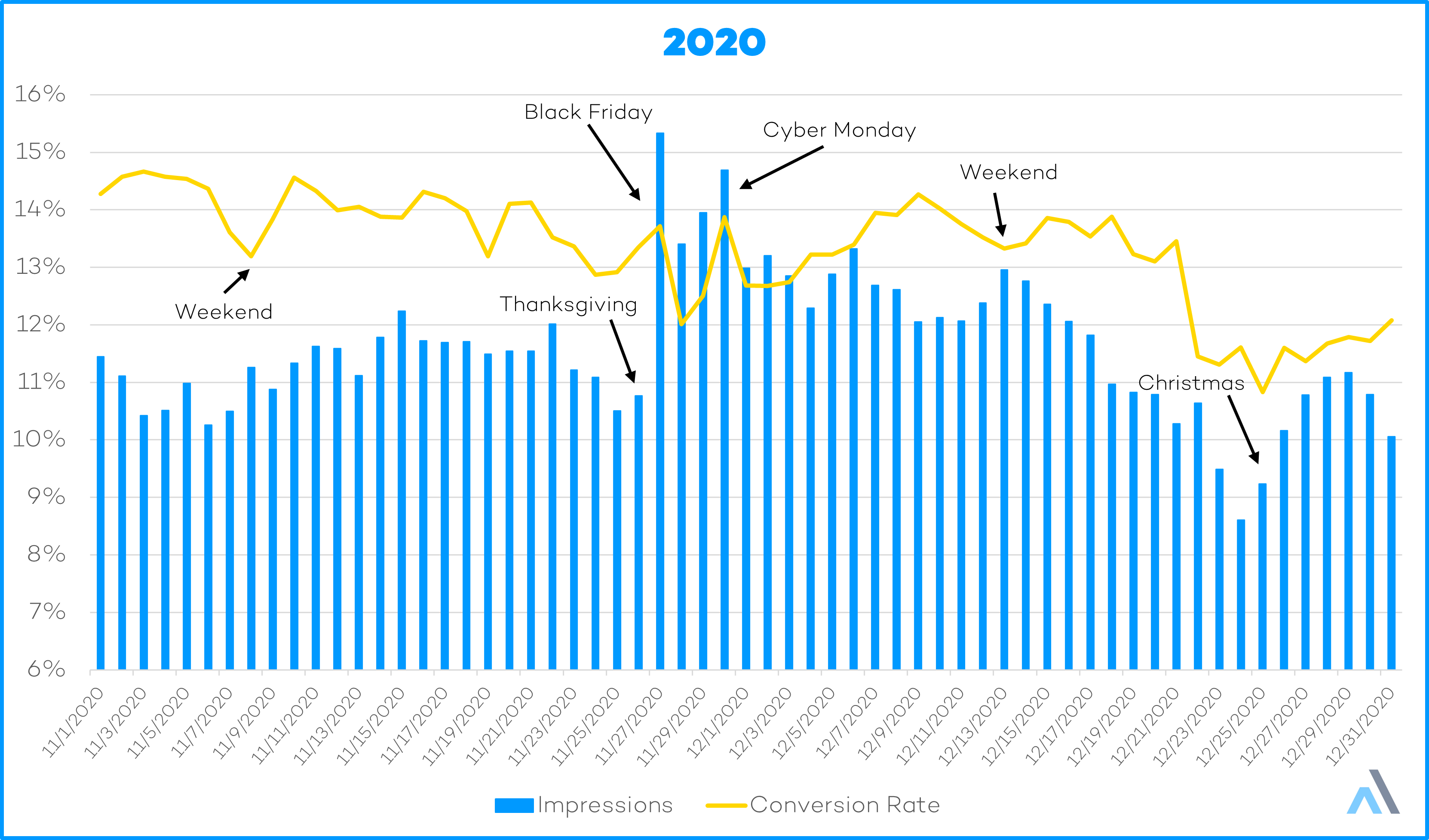

December Dynamics: Early to mid-December consistently shows healthy increases in both traffic and Conversion Rates.

-

Shipping Deadlines: As shipping cutoffs for Christmas delivery approach (typically December 19-21), traffic declines, and Conversion Rates drop sharply.

-

Post-Christmas Activity: Depending on the category, traffic often rebounds after Christmas, driven by shoppers seeking accessories for gifts, using gift cards, or purchasing “New Year, New You” products.

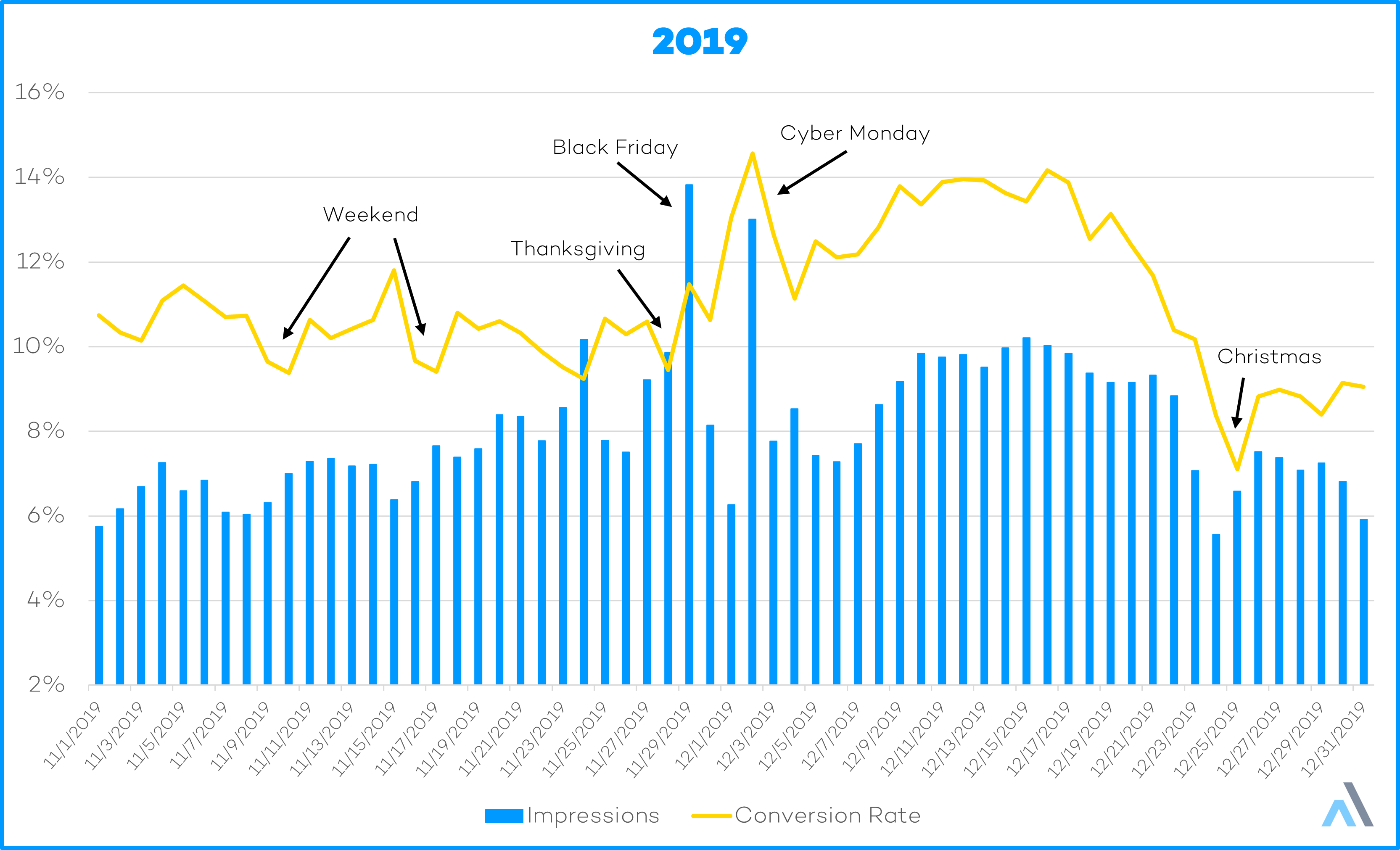

2019 stands out as an anomaly. Before COVID reshaped shopping habits, Black Friday was primarily an in-store event, while Cyber Monday marked the online holiday shopping season’s kickoff. In 2019, Conversion Rates increased markedly after Cyber Monday, remaining high until December 20. A detailed breakdown of this behavior can be found in the 2019 PDF, showcasing a more defined holiday shopping season.

What’s Next?

For brands in “New Year, New You” categories—such as supplements, beauty products, and wellness—Q1 often serves as their Q4. Strategies for this period should already be in place.

Happy selling!